I. Purpose and significance

In order to comprehensively master the current situation of clinical trials of new drug registration in China, promptly disclose the information on the progress of clinical trials, and provide reference for the R&D, resource allocation and drug review and approval of new drugs, Center for Drug Evaluation, NMPA (hereinafter referred to as CDE), based on the registration information of new drug clinical trials in the drug clinical trial registration and information publicity platform, comprehensively summarize and analyze the current situation of clinical trials of new drug registration in China in 2021, analyze the characteristics of trends in the past three years, and gradually use informatization means to help improve drug regulatory capacity.

II. Research method

In this annual report, based on the drug clinical trial information registered in 2021, the overall change trend, main characteristics and prominent problems of the clinical trial are summarized and analyzed from the perspectives of drug type, variety and target characteristics, indications, sponsor type, registration classification, trial classification, trial phase, trial in special populations, leading site of clinical trial, initiation time and completion status. Simultaneously, the clinical trial registration data of the past three years are compared, the trend characteristics in recent years are summarized and analyzed, and the Annual Report on the Progress of Clinical Trials for New Drug Registration in China (2021) is prepared.

III. Main research results

(I) Number of clinical trials for new drug registration

In 2021, the total number of registered clinical trials in the drug clinical trial registration and information publicity platform exceeded 3,000 for the first time, an increase of 29.1% compared with the total number of registered clinical trials in 2020. Among them, the number of clinical trials for new drugs (exploratory and confirmatory clinical trials registered with acceptance number) was 2033, an increase of 38.0% compared with the registration volume in 2020.

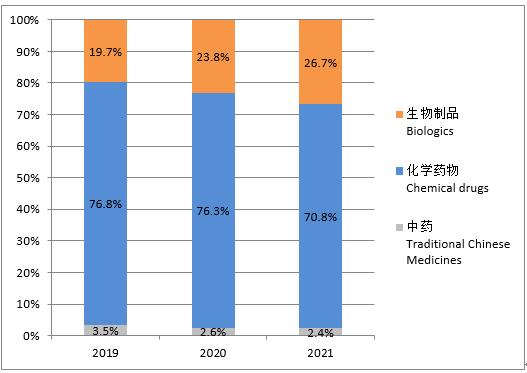

According to the statistics by drug type of traditional Chinese medicines, chemical drugs and biological products, in 2021, the drug clinical trials in China were still dominated by chemical drugs, accounting for 70.8%; followed by biological products, 26.7%; and traditional Chinese medicines were the least, 2.4%. Compared with the data in the past three years, the proportion of clinical trials of various drugs was similar, but the proportion of biological products showed an increasing trend year by year, and the proportion of chemical drugs and traditional Chinese medicines showed a decreasing trend year by year.

Figure 1Overall change in the proportion of each drug type (2019-2021)

(II) Drug type and target characteristics

According to the classification of chemical drugs, biological products and traditional Chinese medicines, from the data analysis in the past three years, the clinical trials for new drugs of chemical drugs and biological products accounted for a relatively high proportion, with an average annual proportion of 54.6% and 40.4% respectively. In the past three years, the targets of the drugs were relatively concentrated, of which PD-1 and PDL1 were particularly prominent, and the indications were also mainly concentrated in the anti-tumor field. Analyzed by trial phase, the proportion of phase III clinical trials of PD-1 and PD-L1 targets is also higher than that of other targets.

1. Varieties for new drug clinical trials

The number of varieties involved in 2033 new drug clinical trials in 2021 (by drug name in clinical trial license document) was statistically analyzed according to different drug types, and the data in the past three years were analyzed.

Traditional Chinese medicine: In 2021, only one clinical trial was carried out for about 90% of traditional Chinese medicine varieties, and the varieties carrying out two clinical trials included Qishen Yiqi Dropping Pills, Suzi Afu Tablets, Baofukang Suppositories and Artificial Bear Bile Powder. For Suzi Afu Tablets, one trial was suspended and the clinical trial was conducted again after the protocol was updated. The overall data trend was basically the same in the past three years, and only one trial was carried out in the same year for nearly 90% of the varieties.

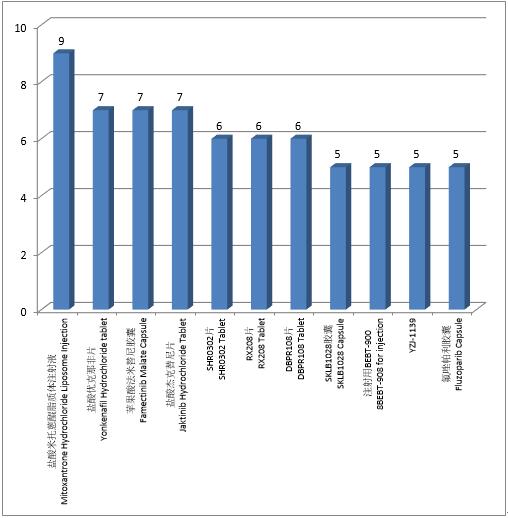

Chemical drugs: A total of 68 trials were registered for the top 10 varieties of chemical drug clinical trials in 2021, with the most trials conducted for mitoxantrone hydrochloride liposome injection (9 trials). Compared with 2020, the similarity is that the top 10 varieties all contain the anti-tumor drugs mitoxantrone hydrochloride liposome injection, famectinib malate capsule, jaktinib hydrochloride tablet and fluzoparib capsule, and the difference is that the top 10 varieties contain 4 nonantitumor drugs, yonkenafi l hydrochloride tablet, SHR0302 tablet, DBPR108 tablet and YZJ-1139 respectively. According to the data analysis in the past three years, each year more than 50% of the top 10 varieties were anti-tumor drugs, of which fluzoparib capsule was one of the top 10 varieties in the past three years.

Figure 2 Top 10 varieties in chemical drug clinical trials in 2021

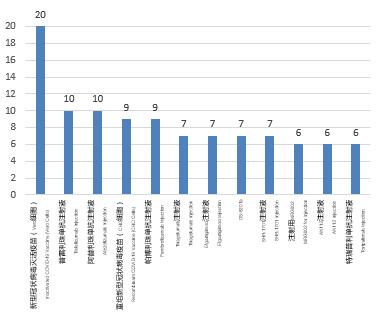

Biological products: In 2021, a total of 104 trials were registered for the top 10 varieties in the number of clinical trials carried out for biological products, mainly therapeutic biological products, involving a total of 75 trials of 10 varieties (72.1%); prophylactic biological products involved 29 trials of 2 varieties (27.9%), all of which were COVID-19 vaccines. From the analysis of the number of clinical trials of a single variety, the number of clinical trials carried out for the inactivated COVID-19 vaccine (Vero cells) was the highest, 20, followed by tislelizumab injection and atezolizumab injection, 10 for both, and both of them were among the top 10 varieties in 2020. Compared with the data in the past three years, the top 10 varieties were mainly therapeutic biological products, with the highest proportion of 88.7% in 2019 (94vs.106). Pembrolizumab injection was one of the top 10 varieties in the past three years.

Figure 3 Top 10 varieties in the biological product clinical trials in 2021

2. Targets of varieties in new drug clinical trials

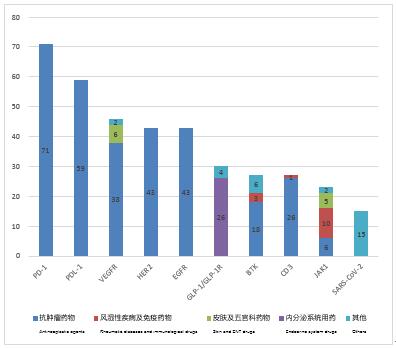

According to the statistics by drug varieties, the top 10 targets of clinical trials registered in 2021 are PD-1, PDL1, VEGFR, HER2, etc., and the number of varieties are as many as 71, 59, 46 and 43, respectively (not repeatedly counted by "acceptance number" field), of which more than 90% of the drug indications of 5 targets (PD-1, PD-L1, HER2, EGFR and CD3) are concentrated in the antitumor field, and all the drug indications of 4 targets (PD-1, PD-L1, HER2 and EGFR) are concentrated in the anti-tumor field.

Figure 4 Number of varieties and indication distribution of top 10 targets in 2021

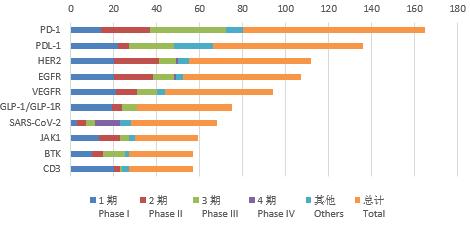

According to the statistics by the number of clinical trials, the top 10 targets with the highest number of clinical trials in 2021 are PD-1, PD-L1, HER2, EGFR, etc., as many as 84, 68, 57 and 53 respectively; among them, there are 36 and 21 Phase III clinical trials for PD-1 and PD-L1 targets respectively. In addition, in the drug clinical trials of 4 targets (VEGFR, GLP-1/ GLP-1R, JAK1 and CD3), phase I clinical trials account for more than 40%, and phase II clinical trials account for 8% ~ 37% of each target.

Figure 5 Number and stage of clinical trials of top 10 targets before 2021

Compared with the data analysis in the past three years, no matter according to the number of drug varieties or clinical trial registrations, the drug targets are still relatively concentrated, of which PD-1 and PD-L1 were particularly prominent, and the indications were also mainly concentrated in the anti-tumor field. Analyzed by trial staging, the proportion of phase III clinical trials of PD-1 and PD-L1 targets is also higher than that of other targets; the trials for other targets are still mainly phase I clinical trials.

3. Varieties in BE trials

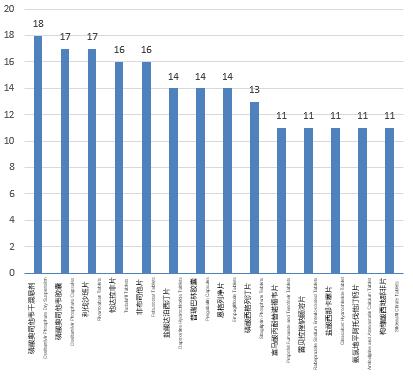

According to the information of the top 10 varieties in BE trials (including the registration with acceptance number) in 2021, the number of clinical trials registered of oseltamivir phosphate dry suspension is the largest (18 trials). See Figure 6 for details.

Figure 6 Top 10 varieties in BE trials in 2021

Compared with the data in 2020, there are four of the same varieties in the top 10 varieties, namely oseltamivir phosphate capsules, rivaroxaban tablets, tadalafil tablets and propofol tenofovir fumarate tablets. From the analysis of the data in the last three years, rivaroxaban tablets were among the top 3 varieties over the years.

(III) Trial classification and sponsor

According to the classification of drug clinical trials by new drug clinical trials and bioequivalence trials (BE trials), new drug clinical trials accounted for 60.5% and BE trials accounted for 39.5% in 2021. According to the data in the past three years, the proportion of new drug clinical trials showed an increasing trend year by year, while the proportion of BE trials showed a decreasing trend year by year, from 47.3% in 2019 to 39.5% in 2021. Domestic sponsors still accounted for the majority, for about 80% in the past three years.

(IV) Target indications and clinical trial phase

The target indications for clinical trials of chemical and biological products mainly focus on the fields of anti-tumor and prophylactic vaccines. Due to the influence of COVID-19, the number of clinical trials of inactivated COVID-19 vaccines ranked first in prophylactic vaccine trials in 2021 (20 trials). In the past three years, traditional Chinese medicine mainly focused on four indications: respiratory, digestive, cardiovascular and psychoneurotic diseases.

The proportion trend of clinical trial stages remained consistent in the past three years, with phase I clinical trials accounting for the highest proportion, and the overall phase I clinical trials account for 42.9% in 2021; clinical trials conducted in specific populations in the past three years were relatively few, and the clinical trials only conducted in the elderly and pediatric populations did not exceed 0.2% and 3% of the overall proportion of trials over the years, respectively. Drugs for rare diseases mainly focus on the treatment of nervous system diseases and hematological diseases, and the number of clinical trials and indication fields are increasing year by year.

(V) Analysis of geographical distribution of clinical trials

The leading site and participating site of clinical trials are still mainly in Beijing, Shanghai, Jiangsu and Guangdong.

(VI) Analysis of the implementation efficiency of clinical trials

Analysis of the new drug clinical trials registered for the first time show that more than half of the trials (51.4%) in 2021 may initiate subject recruitment within 6 months, and the proportion of chemical drugs and biological products significantly exceeded that of traditional Chinese medicines (51.2% and 58.1%, respectively), while nearly nine-tenths (89.1%) of the clinical trials of traditional Chinese medicines initiated subject recruitment for more than 1 year. Combined with the analysis of the location of clinical trial institutions, it is suggested that the initiation of clinical trials in provinces, autonomous regions and municipalities with more leading sites of clinical trials takes more time; while the initiation of clinical trials in provinces, autonomous regions and municipalities with fewer leading sites of clinical trials takes less time.

Analysis of subject recruitment after the initiation of clinical trials in the past three years show that the average initiation time decreased from 6.4 months to 3.8 months from 2019 to 2021, and the proportion of clinical trials initiated within 6 months increased year by year, reaching 85.7% in 2021.

IV. Conclusion

In 2021, the annual total number of registrations on the drug clinical trial registration and information publicity platform exceeded 3,000 for the first time, totaling 3,358. The proportion of new drug clinical trials has been increasing year by year, with phase I clinical trials accounting for the highest proportion over the years, and the trials are mainly domestic trials initiated by domestic sponsors. The proportion of BE trials showed a gradual decrease in the past three years.

In the past three years, the clinical trials of chemical drugs and biological products are still mainly for oncology indications, and the drug targets are relatively concentrated, especially PD-1 and PD-L1, and the number of phase III clinical trials is relatively high. Due to the influence of COVID-19, the number of clinical trials of inactivated COVID-19 vaccines was the largest among biological products of prophylactic vaccines in 2021. The number of clinical trials of traditional Chinese medicine has been the lowest over the years, mainly focusing on four indications: respiratory, digestive, cardiovascular and psychoneurotic diseases.

The proportion of clinical trials conducted in the elderly population and pediatric population (except prophylactic vaccines) is still low, and the types of diseases involved in drug clinical trials for rare diseases are still low. According to the 2021 registration information, the proportion of subject recruitment initiated within 6 months is significantly increased (51.4%).

In conclusion, the number of new drug clinical trials in China is increasing, and most of them are new drug clinical trials initiated and implemented by domestic sponsors. With the increasing number of phase III new drug clinical trials, it is expected that the number of new drug applications for marketing in China will increase and the process will accelerate to meet the demands for new drug for Chinese patients, including the demand for clinical medication for pediatric population and rare diseases.

(June 7, 2022)

News

News

Position :

Position :